The Yuan’s Swift Rebound: Navigating the USD/CNY Dynamics

Quick Look

The USDCNY pair dramatically dropped below 7.2, signalling a sharp strengthening of the Chinese yuan

Chinese state-owned banks intervened, reportedly under directives from the People’s Bank of China (PBOC), to bolster the yuan

Offshore yuan remains above 7.2, despite interventions aimed at curbing the USD/CNY pair’s surge

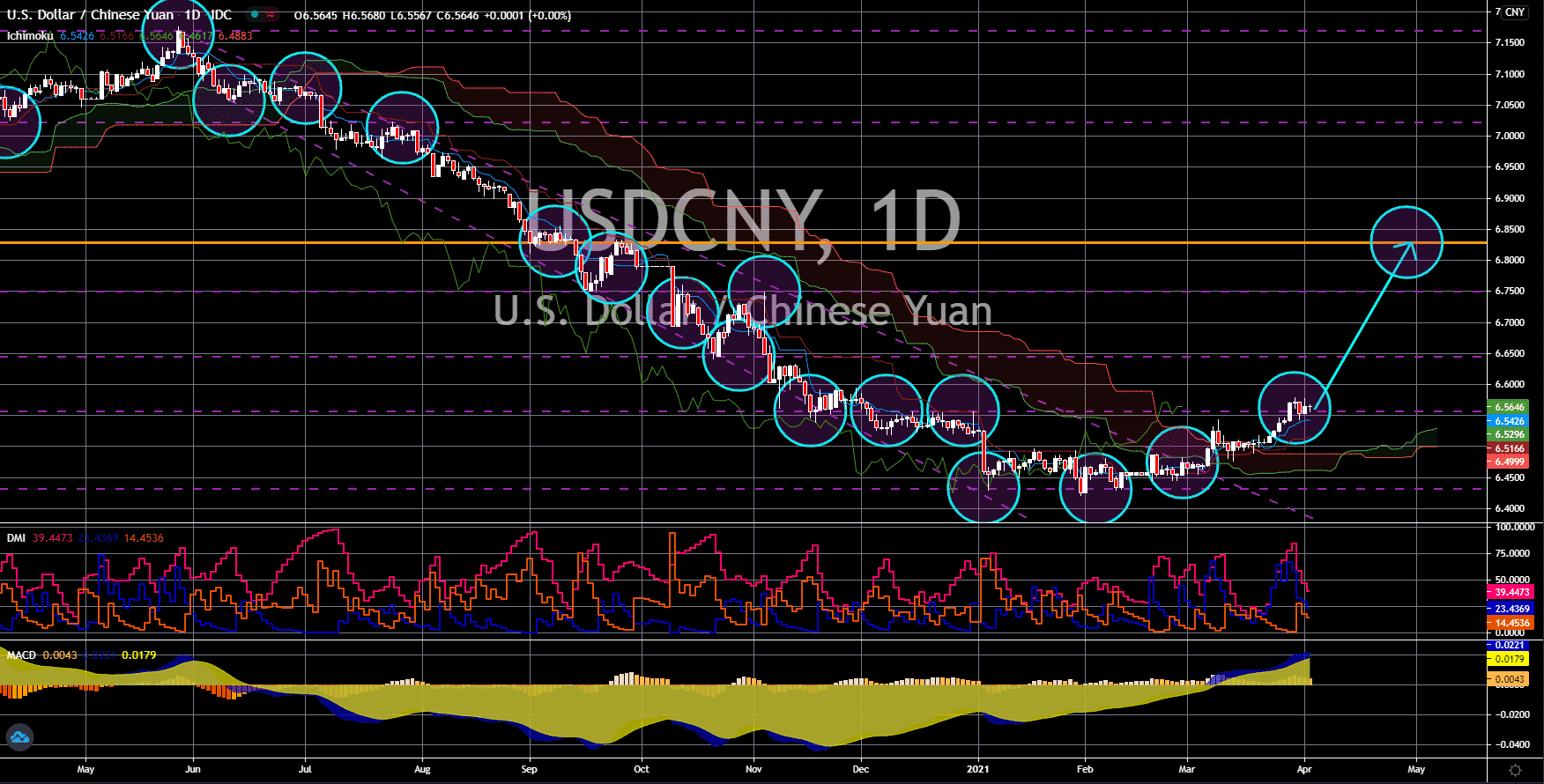

In an unexpected twist in the currency markets on Monday, the Chinese yuan showed remarkable resilience, fortifying sharply against the dollar. This development saw the USD/CNY pair descending below the pivotal 7.2 level, a move that captured the attention of investors and analysts alike. The descent to 7.1978 yuan, marking a 0.4% fall, followed a recent surge to a four-month zenith above 7.2 on Friday. This shift, triggered by a notably stronger-than-anticipated midpoint fix from the People’s Bank of China (PBOC), underscores the intricate dance between policy signals and market dynamics.

In contrast, the offshore yuan (USD/CNH) maintained its position well above the 7.2 threshold, albeit experiencing a 0.5% decline to 7.2371 on Monday. This divergence between onshore and offshore yuan valuations reflects the nuanced interplay of global and local market forces.

State-Backed Maneuvers to Strengthen the Yuan

The yuan’s resilience on Monday can be attributed to deliberate market interventions. Chinese state-owned banks, following instructions, actively purchased yuan and sold dollars. Last week’s efforts aimed to curb the USD/CNY pair’s spike, with Beijing’s policy apparatus expressing unease over the yuan’s weakness. Such interventions underscore the critical balancing act the PBOC must perform in navigating currency market fluctuations while ensuring economic stability.

The recent pressures on the yuan, exacerbated by a pessimistic outlook for China’s economic growth and the dollar’s rise to one-month highs, underscore the challenges facing the Chinese currency. Amid these conditions, the PBOC’s hint at potential benchmark interest rate cuts to stimulate the economy suggests a delicate trade-off between stimulating domestic business activity and managing currency devaluation risks.

USD/CNY: The 7.2 Threshold and Yuan’s Journey

The 7.2 level is more than a numerical marker for the yuan. It acts as a psychological threshold of significant importance. Historical patterns have shown that breaches of this level often lead to further depreciation. This situation paints a complex picture of the currency’s future amidst global economic uncertainties.

Furthermore, the USD/CNY pair’s climb to 17-year highs in mid-to-late 2023, peaking at around 7.3, highlights the yuan’s volatility.

Meanwhile, the efforts of the PBOC and Chinese banking institutions are crucial. They navigate these challenging conditions, providing insights into how to stabilize the currency. Specifically, the yuan’s strengthening against the dollar, especially with strategic interventions, showcases a blend of resilience and policy wisdom. This scenario underscores the ongoing challenges in global finance.

The post The Yuan’s Swift Rebound: Navigating the USD/CNY Dynamics appeared first on FinanceBrokerage.